Gold price near daily low as cautious investors eye upcoming US macroeconomic releases. The precious metal hovers just above $3,300, reflecting ongoing concerns about economic and geopolitical volatility.

Key Takeaways for Gold Price

- Gold price struggles to recover and stays close to its daily low around $3,300.

- Easing US-China trade tensions weaken demand for safe-haven assets like gold.

- Mixed US data and Fed’s dovish outlook continue to support gold in the medium term.

- Market awaits crucial US data releases including GDP and employment figures.

- Technical support seen near $3,265-$3,260, while resistance lies around $3,348-$3,368.

Market Context: Gold Price Weakens Amid Mixed Market Sentiment

The gold price near daily low highlights market unease despite reduced US-China trade tensions. Traders respond to President Trump’s executive order delaying automotive tariffs, which sparked modest optimism in the equity markets. However, this easing of trade friction also dampens safe-haven appeal, keeping pressure on gold.

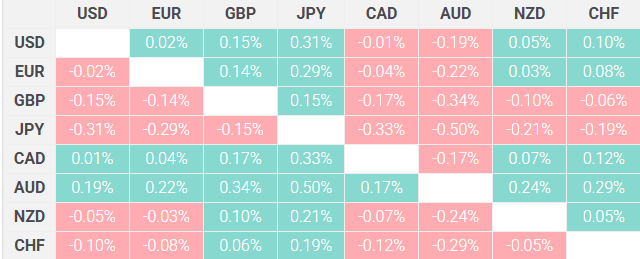

Meanwhile, the US Dollar edges higher due to month-end flows and cautious risk sentiment. Nevertheless, the greenback’s gains remain capped by expectations of aggressive policy easing from the Federal Reserve, offering some cushion for gold.

Uncertainty continues, as Trump’s shifting tone on global trade policies keeps markets nervous. While trade optimism grows, concerns over a potential economic slowdown persist, driving a push-and-pull dynamic between the dollar and gold.

Technical Insights: Key Levels to Watch for XAU/USD

Gold’s technical outlook shows bulls still in control, though price action remains under pressure. Indicators suggest support at $3,265–$3,260, aligned with the 38.2% Fibonacci retracement of the recent rally.

A clear drop below this zone may expose the $3,225 level, with extended losses targeting the $3,200 mark. On the upside, immediate resistance stands at $3,328, followed by $3,348–$3,353. A sustained move above $3,368 could set the stage for another attempt at $3,400 and possibly $3,500.

Economic and Geopolitical Developments Supporting Gold

Recent US economic data paints a picture of weakness. The latest JOLTS report revealed a drop in job openings to 7.19 million from 7.48 million. Simultaneously, consumer confidence tumbled to a five-year low at 86.0, with both Present Situation and Expectations indices declining sharply.

These indicators reinforce bets that the Fed will continue easing monetary policy, which traditionally supports non-yielding assets like gold. According to Daily Gold Signal, this dovish stance remains a key driver for gold prices amid global uncertainty.

In geopolitics, escalating tensions around Ukraine remain a concern. Russia rejected a proposal to extend a ceasefire, while the US warned of withdrawing diplomatic efforts without concrete steps from both parties. These developments could limit gold’s downside and increase its appeal as a safe-haven investment.

Expert Insight

Analysts suggest that the gold market is currently moving through a challenging and uncertain environment. “The conflicting cues from macroeconomic data, central bank policy expectations, and global political events are creating volatility and indecisiveness in gold,” says Alex Turner, a commodities strategist based in London.

“Gold may remain range-bound in the short term, but strong support levels and dovish central banks should keep the downside limited,” Turner added.

Conclusion: Gold Awaits Direction from Upcoming US Data

With the gold price near daily low, market participants are turning their attention to upcoming US data releases. The ADP employment report, Q1 GDP, and PCE inflation data due Wednesday, along with Friday’s Nonfarm Payrolls, will be pivotal in shaping the Fed’s rate path and gold’s next move.

Until then, traders can expect range-bound movement between key support and resistance zones. However, with economic uncertainty and geopolitical risks simmering, gold continues to find favor as a defensive asset.

Explore more insights and real-time analysis on Daily Gold Signal.

Frequently Asked Questions (FAQs)

1.Why is the gold price near its daily low today?

The gold price is near its daily low due to easing US-China trade tensions, stronger US Dollar flows, and market anticipation of key US economic data, which reduce safe-haven demand.

2.What economic data is impacting gold prices this week?

Major US economic indicators such as the ADP employment report, Q1 GDP, and the PCE Price Index are influencing gold prices. These reports help shape expectations for future Fed policy actions.

3.How does the Federal Reserve affect the gold price?

The Federal Reserve impacts gold by adjusting interest rates. Lower rates make non-yielding assets like gold more attractive, often causing prices to rise when dovish policy is expected.

4.What technical levels should traders watch for gold?

Support is seen around the $3,265–$3,260 range, while resistance lies near the $3,348–$3,368 zone. A break below or above these levels could signal the next significant move.

5.Can geopolitical events still support gold prices?

Yes, geopolitical tensions, such as the conflict between Russia and Ukraine, can increase demand for safe-haven assets like gold, helping to limit downside pressure even amid improving trade sentiment.