Gold price in Pakistan declined significantly on Thursday as the precious metal faced domestic and global pressures.

Key Highlights for Gold Price

- 24-karat gold fell to Rs335,200 per tola, down Rs6,700 from the previous session.

- 22-karat gold is quoted at Rs263,440 per 10-gram, reflecting a clear downward trend.

- Global gold prices fell to around $3,173 per ounce, losing $12.2 or 0.38%.

Domestic Gold Market Overview and Price Trends

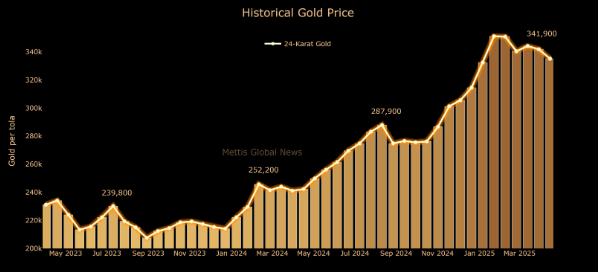

The local gold market saw a significant correction on May 15, 2025, following days of elevated prices. According to the All-Pakistan Gems and Jewelers Sarafa Association (APGJSA), this drop reflects both local buying trends and adjustments in global pricing.

- Gold prices have dropped Rs12,800 over the past month, showing increased volatility.

- Fiscal year to date (FYTD), gold remains up by Rs93,500, pointing to long-term strength.

- Silver has mirrored gold’s decline, with the 10-gram price down Rs90 to Rs2,895.

For historical trends, expert insights, and daily updates, visit Daily Gold Signal.

Global Market Context

Global gold prices slightly rebounded after early losses, aided by a weaker U.S. dollar and selective buying.

Key market factors include:

- Dollar Weakness: A declining dollar boosted gold’s appeal to non-dollar investors.

- Technical Buying: Traders are capitalizing on dips amid tight price movements.

- Interest Rate Speculation: Investors await U.S. economic data expected to shape future interest rate decisions.

Geopolitical tensions and inflation concerns continue to support long-term gold demand, despite short-term corrections.

Technical Analysis and Price Outlook

From a technical perspective, gold has faced resistance near the $3,190 mark. Current consolidation indicates a wait-and-watch stance by investors ahead of U.S. retail sales and jobless claims data.

- Support Levels: $3,150 and $3,120 remain crucial for bullish sustainability.

- Resistance Levels: A breakout above $3,190 could signal renewed upward momentum.

Domestic gold could see further downside if global trends continue, but demand remains solid due to local hedging needs and economic uncertainty.

Expert Opinion

According to analysts from the Pakistan Bullion Forum, “Today’s decline is largely technical, not fundamental. A mild rebound is possible if U.S. data softens and Fed signals rate cuts.”

They also note that seasonal buying ahead of Eid and wedding season could support local prices in the coming weeks, especially if the rupee weakens further.

Conclusion: What’s Next for Gold Prices?

The gold price in Pakistan has taken a notable hit, reflecting both domestic adjustments and global cues. However, overall market sentiment remains cautiously optimistic amid broader economic uncertainties. Investors should watch upcoming U.S. monitor data releases carefully for insights into upcoming market trends.

Stay informed with real-time gold updates and expert analysis by visiting Daily Gold Signal’s Daily Gold Update section.

FAQs About Gold Prices in Pakistan

1. Why did the gold price in Pakistan drop by Rs6,700 per tola?

The decline in gold price is due to both domestic market adjustments and global factors such as a weaker U.S. dollar and cautious investor sentiment.

2. What is the current price of 24-karat gold per tola in Pakistan?

As of May 15, 2025, the price of 24-karat gold in Pakistan stands at Rs335,200 per tola.

3. How does global gold price affect the local gold market in Pakistan?

Global gold prices influence Pakistan’s market because local rates often follow international trends, impacted by currency fluctuations and global economic events.

4. Are silver prices also affected by the same factors as gold?

Yes, silver prices in Pakistan have fallen similarly due to global market trends and domestic demand changes.

5. Where can I find reliable daily updates on gold prices in Pakistan?

You can visit Daily Gold Signal for trusted and timely updates on gold prices and market analysis.