Gold dips as traders place more weight on upcoming US-China trade talks than on rising military tension between India and Pakistan. The price of gold slipped to $3,390 on Wednesday, with investors feeling cautiously optimistic ahead of the US Federal Reserve’s interest rate decision.

Key Takeaways

- Gold dips to $3,390 as trade optimism overshadows geopolitical conflict.

- US-China talks aim to calm tensions, not finalize an agreement.

- India-Pakistan conflict fails to lift gold despite rising risk.

- Technical indicators suggest possible rebound if talks disappoint.

Market Overview: Trade Talks Take Center Stage

Gold prices fell mid-week as global attention turned to easing tensions between the United States and China. US Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer are set to meet with China’s Vice Premier He Lifeng in Switzerland. These talks are not meant to finalize a trade deal but rather to start de-escalation.

This early move boosted investor confidence, reducing demand for safe-haven assets like gold. As a result, gold dips, even though tensions elsewhere are heating up.

India-Pakistan Conflict: War Tensions Linger, But Gold Dips

Military tensions between India and Pakistan escalated overnight. According to reports, Pakistan claimed it downed five Indian jets and captured several soldiers in response to an Indian airstrike. Normally, such geopolitical risks would push gold prices higher.

However, the market is currently prioritizing trade stability. According to Bloomberg, investors are putting more focus on US-China progress than on regional conflict. This explains why gold dips, as trade optimism takes precedence over geopolitical risks.

Expert Insight: Caution Advised Despite High Prices

Speaking to the Financial Times, the executive advised staying cautious and avoiding past mistakes made during previous market highs.

This advice serves as a reminder that strong prices don’t always guarantee safe investments, especially in volatile global conditions.

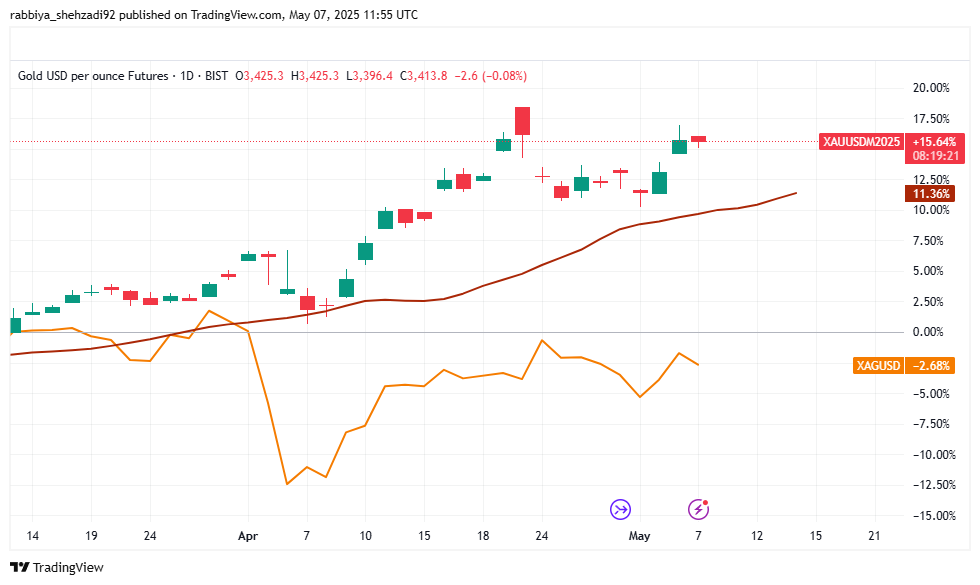

Gold Price Technical Analysis

If headlines around trade talks turn negative or the Fed decision surprises, gold may surge again. Key levels to watch:

- Resistance 1 (R1): $3,469 – Could be tested if news disrupts trade optimism.

- Resistance 2 (R2): $3,508 – Becomes relevant if gold breaks a new high.

- Pivot Point: $3,396 – A critical level to monitor for daily closing prices.

- Support 1 (S1): $3,358 – First downside level to watch.

- Support 2 (S2): $3,285 – The next support level.

- Major Support: $3,245 – Strong support in case of sharp reversal.

Despite the pullback, many analysts believe the gold uptrend remains intact unless prices drop below $3,245.

Federal Reserve in Focus: Steady Rates Expected

The Federal Reserve is expected to leave interest rates unchanged during Wednesday’s policy meeting. According to the CME FedWatch Tool, the probability of no rate change is above 95%. Although President Biden has urged the Fed to cut rates, Chairman Jerome Powell appears likely to maintain current levels until the effects of tariffs and inflation become clearer.

Conclusion: Trade Talks May Shape Gold’s Next Move

Gold remains in a balancing act. While geopolitical risks usually support prices, current optimism around trade talks is pushing them lower. If discussions between the US and China go poorly or the Fed surprises markets, gold could quickly rebound.

Until then, gold dips remain a result of reduced fear and cautious optimism in global markets.

For more updates, visit Daily Gold Signal. See detailed price reports in our Daily Gold Update section.

FAQs About Gold Dips and Market Movements

1. Why did gold dip despite rising India-Pakistan tensions?

Gold dipped because investors focused more on easing US-China trade tensions than regional conflicts. Market optimism reduced demand for gold as a safe-haven asset.

2. How do US-China trade talks affect gold prices?

Progress in US-China trade talks can calm global markets, reducing fear-driven gold buying and causing prices to drop.

3. What role does the Federal Reserve play in gold price movements?

The Federal Reserve’s interest rate decisions influence gold prices. Steady rates reduce gold’s appeal compared to interest-bearing assets.

4. What technical levels should traders watch for gold?

Key levels include resistance at $3,469 and $3,508, and support around $3,285 and $3,245.

5. Is the gold market still in an uptrend?

Yes, despite the dip, the overall uptrend remains intact unless gold drops below major support levels.

6. Could gold prices rise again soon?

Yes, if trade talks collapse or the Fed surprises the market, gold could see a strong rebound.