The UK-US trade deal impact on gold became evident on Thursday as the metal slipped slightly. This minor pullback came as market sentiment improved on trade developments and commentary from the US Federal Reserve, offering new dynamics for traders to consider.

Key Market Takeaways

- Gold declined under 1%, stabilizing near $3,343 during Thursday’s early session.

- Markets await the formal announcement of a new trade agreement between the UK and US.

- The Federal Reserve kept interest rates steady, referencing the ongoing stability of the U.S. economy.

- Technical indicators highlight key resistance and support zones for short-term movement.

- Hedge funds continue to back gold despite improved risk sentiment.

Global Markets Eye Fed Decision and Policy Tone

On Wednesday, the Federal Reserve interest rates were held steady in the 4.25% to 4.50% range. While this move met market expectations, Chair Jerome Powell’s cautious tone grabbed investor attention.

He acknowledged economic resilience in the short term but warned that long-term uncertainties, including tariffs and trade disruptions, may weigh on growth. The UK-US trade deal impact on gold adds another layer to how markets digest these ongoing global developments.

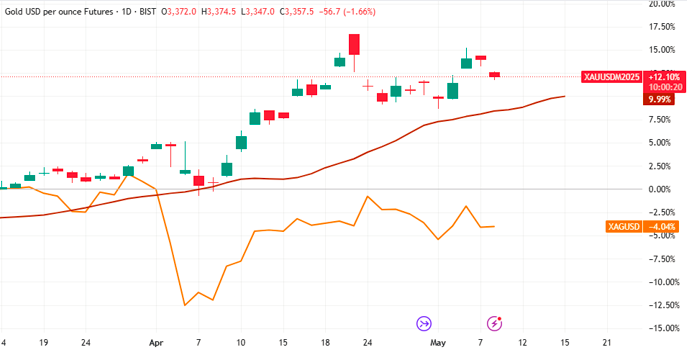

Gold Resistance Levels Offer Insight into Short-Term Moves

During Thursday’s Asian session, gold attempted to rise but was pushed back near the R1 resistance at $3,413. If the expected deal proves underwhelming or delayed, gold could swiftly retest that level.

A break above R1 would likely open the door toward R2 resistance at $3,462, depending on external factors. On the downside, $3,338 offers immediate support, followed by a soft floor at $3,311, with stronger technical defense positioned around $3,245.

Hedge Funds Confident Despite Trade Deal Optimism

Bloomberg reports that Waratah Capital Advisors Ltd. is increasing its exposure to gold, expecting strong performance ahead. The firm believes that while trade developments offer short-term relief, deeper market risks remain unresolved.

Their view reflects broader investor sentiment — optimism around trade doesn’t eliminate gold’s safe-haven appeal. As global inflation persists and currency volatility remains a threat, gold continues to attract institutional interest.

Conclusion: Temporary Calm, Long-Term Uncertainty for Gold

While global markets welcome potential progress in US-UK trade relations, gold’s pullback reflects restrained enthusiasm. Technical levels and economic policy signals suggest a cautious path forward for traders. With no immediate changes to the Federal Reserve interest rates and geopolitical risks still present, the long-term gold market forecast remains strong.

Get more expert insights at Daily Gold Signal. Follow the latest updates in the Daily Gold Update section.