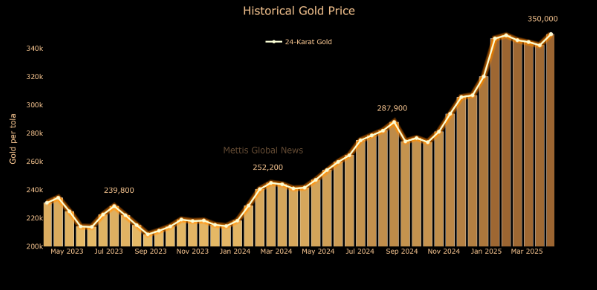

On Monday, May 5, 2025, the gold market in Pakistan saw a significant surge, with the price of 24-karat gold increasing by Rs7,800 per tola. The value of gold per tola reached Rs350,000, while the price of silver also experienced an uptick. This article explores the latest price movements, the factors driving these changes, and an overview of the global market context.

Key Takeaways

- The price of 24-karat gold in Pakistan increased by Rs7,800 per tola, reaching Rs350,000.

- The price of 24-karat gold per 10 grams increased to Rs300,068, a rise of Rs6,687.

- Silver prices also increased, with 24-karat silver now costing Rs3,425 per tola.

- Globally, spot gold traded near $3,314 an ounce, gaining over $66.1.

Detailed Analysis of the Gold Market in Pakistan

Market Context

Gold has long been seen as a hedge against economic uncertainty, and recent market movements are no exception. The local price hike on Monday came after a series of fluctuating trends both domestically and globally. The weakening Pakistani Rupee, combined with the global price rise, has made gold more expensive in the local market.

The currency devaluation, paired with international shifts in gold pricing, has contributed to the surge in gold prices. Furthermore, investors’ attention is also focused on global economic developments, such as U.S.-China trade negotiations, which have the potential to influence gold’s safe-haven demand.

Technical Insights

The recent increase in gold prices can be attributed to several technical indicators. The rising trend is supported by an upward movement above key resistance levels. The current price of Rs350,000 per tola has exceeded recent highs, signaling a potential continuation of the bullish trend. Additionally, the 10-gram price of 24-karat gold has also experienced a significant jump, reaching Rs300,068.

Looking at silver, the price rise was smaller but still notable, with 24-karat silver rising by Rs43 per tola and Rs37 per 10 grams. Silver has traditionally followed the price movement of gold, and these changes reflect broader market trends.

Expert Opinions

Several market experts have weighed in on the situation. According to a statement from an APGJSA representative, “The rise in gold prices is primarily due to global market factors and the recent instability in the Pakistani Rupee.” They also emphasized that “local demand for gold remains high as consumers seek refuge in precious metals amidst inflationary pressures.”

Global Context of Gold Prices

Gold’s price surge is also mirrored on the global stage. As of the latest data, spot gold traded near $3,314 per ounce, a rise of $66.1 or 2.04% from the previous session. Analysts attribute the price increase to a weakening U.S. dollar, which boosted investor demand for gold. Additionally, markets are closely watching the U.S.-China trade negotiations, which could further influence gold’s role as a safe-haven asset.

Conclusion

In summary, the gold price in Pakistan saw a significant rise of Rs7,800 per tola on May 5, 2025, with the value of 24-karat gold reaching Rs350,000. This price hike is influenced by global factors such as the weakening U.S. dollar and uncertainty surrounding international trade talks. As the global market continues to evolve, it is essential for investors to remain vigilant and consider gold as a strategic asset for diversification and wealth protection.

For more detailed updates on gold prices, visit Daily Gold Signal. For the latest gold market insights and trends, check out Daily Gold Update.

FAQs: Gold and Silver Price Update in Pakistan (May 5, 2025)